MANILA, Philippines – If you had Php20,000 in capital for a business, a legitimate one of course, how much can you expect to earn in 7 months? Perhaps many would have been able to double or triple that amount but one woman was able to not just quadruple hers but actually earn Php100,000.

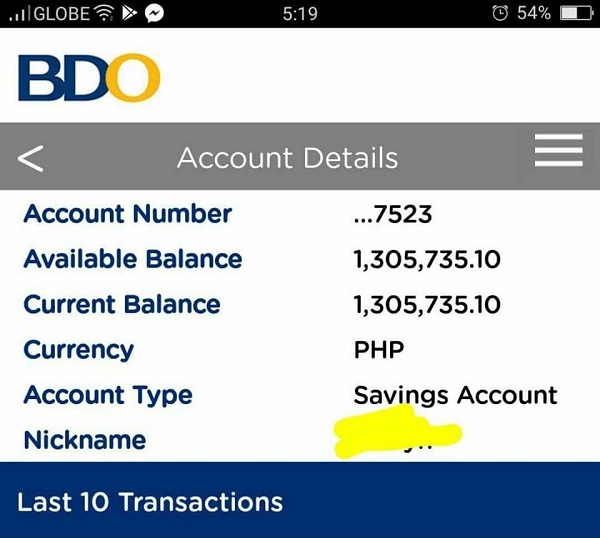

She didn’t stop after getting her first 6-digit savings; instead, she worked harder and was able to save Php1.3 million some months later! What made her achievement even more incredible is that she wasn’t even rich to begin with, and actually just earns the minimum wage! Whoa.

So, how did she get that Php1.3-million savings the legal, legitimate way?

The woman, who chose to remain anonymous, shared her inspiring success story on PESO SENSE, a Facebook page dedicated to teaching Filipinos how to save money and financially independent.

Cutting Back on Expenses

The first step to financial freedom is often the most difficult one: cutting back on expenses. This means putting needs over wants.

For this minimum-wage earner with a Php12,000/month salary, life certainly wasn’t easy but she made sure to always save Php5,000 of her salary in the bank. She gives Php3,000 support to her parents. The remaining Php4,000 she uses to pay the bills (Php2,000) and allowance for herself (Php2,000).

But cutting back on expenses alone wouldn’t make you rich! Even with a huge chunk of her salary going to savings, that would still just give her Php35,000 in her target of 7 months.

Getting a Sideline Job

Inspired by tips she read on the page, this wise woman used Php20,000 from her savings to start a business. Because she didn’t have a lot of capital, she became a reseller. She was lucky to find a supplier who allowed her to sell products on a consignment basis – she only pays the supplier once she sells the items.

But even when the items were sold, she didn’t immediately pay back the supplier. Instead, she used the money to buy more items from other sellers and suppliers, only paying back the consignment supplier when she got back her original capital. The supplier didn’t mind because she always paid up and had good PR with this person.

She also found ways to buy the products for a cheaper price, such as buying items in bulk at wholesale prices. This gave her the chance to mark up the goods for up to 70 to 100% her capital!

As she grew her business, she also made sure to stay in the suppliers’ good graces and she never forgot to save some of her earnings. Who would have thought that in 7 months, she would be able to save a total of Php120,000?

She continued working at her minimum wage job even as she grew her business. Months later, her bank account has increased to Php1.3 million!

Everyone else would tell you that a minimum wage earner would never have Php1 million in his/her bank account. Well, that might be true 99.99% of the time but this wise woman proves that all it takes is a lot of hard work and determination to make it happen… and you don’t even have to win the lottery to reach that million mark!

— Danielle Ramos, The Summit Express

She didn’t stop after getting her first 6-digit savings; instead, she worked harder and was able to save Php1.3 million some months later! What made her achievement even more incredible is that she wasn’t even rich to begin with, and actually just earns the minimum wage! Whoa.

|

| Photo credit: Facebook / PESO SENSE |

So, how did she get that Php1.3-million savings the legal, legitimate way?

The woman, who chose to remain anonymous, shared her inspiring success story on PESO SENSE, a Facebook page dedicated to teaching Filipinos how to save money and financially independent.

Cutting Back on Expenses

The first step to financial freedom is often the most difficult one: cutting back on expenses. This means putting needs over wants.

For this minimum-wage earner with a Php12,000/month salary, life certainly wasn’t easy but she made sure to always save Php5,000 of her salary in the bank. She gives Php3,000 support to her parents. The remaining Php4,000 she uses to pay the bills (Php2,000) and allowance for herself (Php2,000).

But cutting back on expenses alone wouldn’t make you rich! Even with a huge chunk of her salary going to savings, that would still just give her Php35,000 in her target of 7 months.

Getting a Sideline Job

Inspired by tips she read on the page, this wise woman used Php20,000 from her savings to start a business. Because she didn’t have a lot of capital, she became a reseller. She was lucky to find a supplier who allowed her to sell products on a consignment basis – she only pays the supplier once she sells the items.

But even when the items were sold, she didn’t immediately pay back the supplier. Instead, she used the money to buy more items from other sellers and suppliers, only paying back the consignment supplier when she got back her original capital. The supplier didn’t mind because she always paid up and had good PR with this person.

She also found ways to buy the products for a cheaper price, such as buying items in bulk at wholesale prices. This gave her the chance to mark up the goods for up to 70 to 100% her capital!

As she grew her business, she also made sure to stay in the suppliers’ good graces and she never forgot to save some of her earnings. Who would have thought that in 7 months, she would be able to save a total of Php120,000?

She continued working at her minimum wage job even as she grew her business. Months later, her bank account has increased to Php1.3 million!

Everyone else would tell you that a minimum wage earner would never have Php1 million in his/her bank account. Well, that might be true 99.99% of the time but this wise woman proves that all it takes is a lot of hard work and determination to make it happen… and you don’t even have to win the lottery to reach that million mark!

— Danielle Ramos, The Summit Express